The Essential Role of Accurate Bookkeeping in Business Success

The Essential Role of Accurate Bookkeeping in Business Success In the world of business, the importance of a skilled bookkeeper…

The Essential Role of Accurate Bookkeeping in Business Success

The Essential Role of Accurate Bookkeeping in Business Success In the world of business, the importance of a skilled bookkeeper…

The Ultimate Guide to Finding the Best Bookkeeper for Your Industry

The Ultimate Guide to Finding the Best Bookkeeper for Your Industry In the world of small business, a competent bookkeeper…

When to Hire a Professional Bookkeeping Service

When to Hire a Professional Bookkeeping Service For many business owners, managing finances is often a juggling act. While some…

Finding the Right Bookkeeper to Manage Your Financial Statements

Finding the Right Bookkeeper to Manage Your Financial Statements In the dynamic landscape of small business ownership, understanding your financial…

How Outsourcing Your Bookkeeper Can Save You Time and Money

How Outsourcing Your Bookkeeper Can Save You Time and Money In the fast-paced world of small business, every decision you…

Efficient Business Finances: The Power of a Bookkeeper

Efficient Business Finances: The Power of a Bookkeeper In the dynamic world of small business, maintaining financial health can feel…

How Professional Bookkeeping Solves Your Small Business Financial Woes

How Professional Bookkeeping Solves Your Small Business Financial Woes In the ever-evolving landscape of small business ownership, navigating financial complexities…

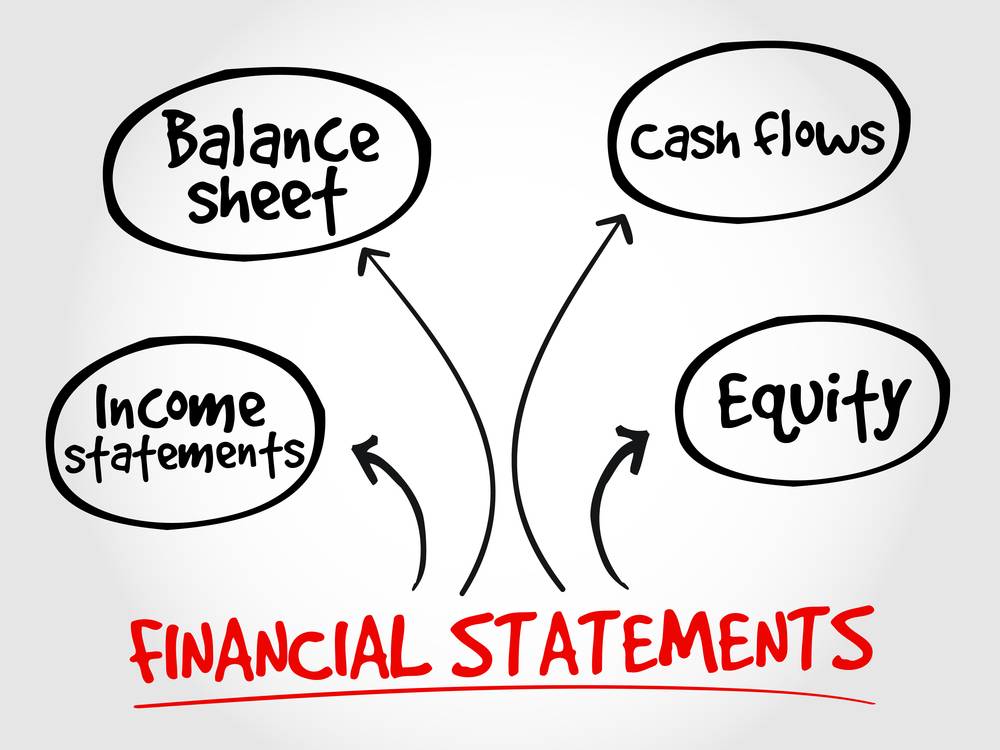

Demystifying Financial Statement Reporting: What You Need to Know

Demystifying Financial Statement Reporting: What You Need to Know When it comes to running a successful business, understanding your financials…

Tailoring Financial Reports: A Bookkeeper’s Perspective for Small Business Owners

Tailoring Financial Reports: A Bookkeeper’s Perspective for Small Business Owners As a bookkeeper, I have seen firsthand the impact that…

Tailoring Financial Reports: A Bookkeeper’s Perspective for Small Business Owners

Tailoring Financial Reports: A Bookkeeper’s Perspective for Small Business Owners As a bookkeeper, I have seen firsthand the impact that…

The Integral Role of Financial Reporting: A Guide for Every Business

The Integral Role of Financial Reporting: A Guide for Every Business When it comes to running a successful business, one…

The Ultimate Goal of Financial Reporting Explained

The Ultimate Goal of Financial Reporting Explained For business owners, grasping the financial well-being of their company is vital for…

Financial Reporting: Essential Knowledge for Small Business Bookkeepers

Financial Reporting: Essential Knowledge for Small Business Bookkeepers When it comes to running a successful small business, understanding your financial…

The Ultimate Goal of Financial Reporting Explained

The Ultimate Goal of Financial Reporting Explained For business owners, grasping the financial well-being of their company is vital for…

The Bookkeepers Guide: 5 Crucial Steps of Financial Reporting

The Bookkeepers Guide: 5 Crucial Steps of Financial Reporting As a small business owner, ensuring accurate financial reporting is essential…

Deciphering the Purpose of Financial Reporting: A Guide for Small Businesses

Deciphering the Purpose of Financial Reporting: A Guide for Small Businesses As a small business owner, you may have heard…

Streamlining Your Bookkeeping: A Closer Look at the 4 Types of Financial Reports

Streamlining Your Bookkeeping: A Closer Look at the 4 Types of Financial Reports If you’re a business owner, you understand…

Unraveling the Simplicity of Bookkeeping Methods for Your Business

Unraveling the Simplicity of Bookkeeping Methods for Your Business Are you seeking relief from the complexities of managing bookkeeping for…

Unlocking the Mysteries of Proper Bookkeeping

Unlocking the Mysteries of Proper Bookkeeping In the world of business, proper bookkeeping is essential for understanding the financial health…