Fix Credit Report Errors in 3 Easy Steps with Our Affordable DIY Credit Program

Are you struggling with inaccurate information on your credit report? It’s a common issue that can prevent you from achieving financial goals like buying a home, securing a loan, or even qualifying for a credit card. The good news is that you don’t have to rely on expensive credit repair services to fix these errors. With our Affordable DIY Credit Program, you can fix credit report errors in just 3 easy steps. Let’s dive into how our program can help you take control of your credit and improve your financial future.

Affordable DIY Credit Program: How to Fix Credit Report Errors in 3 Simple Steps

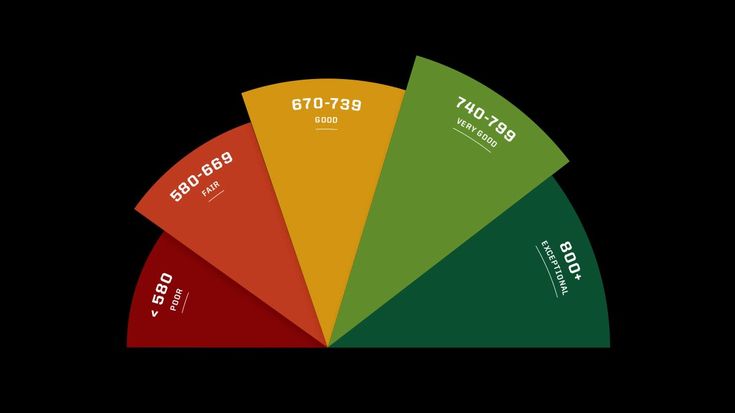

Your credit report is a snapshot of your financial history, and it plays a huge role in determining your credit score. Errors, such as late payments, accounts that don’t belong to you, or incorrect balances, can drag down your score and affect your ability to access credit. If you’re looking to remove collections from your credit report, addressing these errors is the first step to rebuilding your credit and unlocking better loan terms.

The Easiest Way to Fix Credit Report Errors: Affordable DIY Credit Program in 3 Steps

Fixing your credit report doesn’t have to break the bank. While many credit repair companies charge hefty fees for basic services, our Affordable DIY Credit Program gives you the tools and knowledge you need to fix errors on your own. Here’s why our program stands out:

- Cost-effective: You’ll save money by doing it yourself, while still getting expert guidance.

- Empowering: Take control of your financial future by learning how to manage and improve your credit report.

- Fast and efficient: Our simple 3-step process ensures you can correct errors quickly and efficiently.

Step 1: Obtain Your Credit Report

The first step to fixing credit report errors is knowing exactly what’s on your credit report. You can get a free copy of your credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com. You should review all three reports, as the information on them may differ. Look for any errors, including:

- Incorrect late payments

- Accounts you don’t recognize

- Misspelled names or addresses

- Incorrect account balances

- Any collections that don’t belong to you

Tip: You are legally entitled to one free credit report from each bureau every year. If you spot errors, you can request a correction for free.

Step 2: Dispute the Errors

Once you’ve identified errors, it’s time to dispute them. Our Affordable DIY Credit Program will guide you through the process of disputing these inaccuracies with the credit bureaus. Disputing an error typically involves the following:

- Filing a dispute: Each credit bureau has an online portal where you can file a dispute. In most cases, you can select the error you want to dispute and provide any supporting documentation (such as bank statements or letters) that proves the mistake.

- Explain why it’s incorrect: In your dispute, make sure to explain why the information is incorrect. This could include things like showing a payment was made on time or providing evidence that a collection account doesn’t belong to you.

- Wait for a response: The credit bureaus are required to investigate your dispute within 30 days. They’ll notify you of the results, and if they agree the error was made, they will correct it on your credit report.

Tip: Be sure to keep track of your disputes and any correspondence with the credit bureaus for reference.

Step 3: Follow Up and Monitor Your Progress

The final step is to follow up and monitor your credit report for changes. Once the errors are disputed, it’s essential to check your credit reports to ensure they were updated correctly. Additionally, you’ll want to monitor your credit score and report for any new discrepancies in the future. Here are a few ways to do that:

- Check your credit regularly: After the dispute process, keep a close eye on your credit reports to ensure no new errors pop up. Regular monitoring helps you spot any signs of identity theft or other issues early.

- Use credit monitoring services: Many credit card companies or third-party services offer credit monitoring that can alert you to changes in your credit report.

Tip: If you have collections removed from credit during the dispute process, make sure to keep track of these changes as they can significantly boost your credit score.

3 Simple Steps to Fix Your Credit Report with Our Affordable DIY Credit Program

The great thing about our Affordable DIY Credit Program is that it doesn’t just guide you through the dispute process. It also offers expert advice and step-by-step instructions to help you:

- Fix credit report errors: The program outlines how to identify errors on your credit report, how to dispute them, and what documentation is needed.

- Avoid costly mistakes: With expert guidance, you avoid common pitfalls that can delay the dispute process, ensuring a faster turnaround time for corrections.

- Boost your credit score: As errors are removed from your credit report, your credit score will likely improve, opening doors for better financial opportunities like lower interest rates and improved loan approvals.

Affordable DIY Credit Program: Correct Credit Report Errors Fast with These 3 Easy Steps

Correcting errors on your credit report can lead to significant improvements in your credit score, giving you the financial freedom to:

- Secure better loan rates: Lenders offer lower interest rates to individuals with better credit scores, saving you money on mortgages, car loans, and credit cards.

- Get approved for loans and credit cards: A higher credit score increases your chances of getting approved for loans, mortgages, and credit cards.

- Rebuild your credit: If your credit report contains errors, it’s difficult to improve your credit score. Fixing those errors is the first step to rebuilding and maintaining good credit.

Take Action: Start Fixing Your Credit Today

Are you ready to take control of your credit report and financial future? With our Affordable DIY Credit Program, you can fix credit report errors in 3 easy steps, without the need for expensive services. By following our program’s simple, actionable steps, you’ll be on your way to a cleaner credit report and better financial opportunities.

Get started today! Visit Centssavvy.com to access our comprehensive DIY credit repair tools and start correcting errors on your credit report. Empower yourself with the knowledge and resources you need to improve your credit and take the next step toward achieving your financial goals.