Credit Score Increase Tricks for Debt Consolidation: Boost Your Score While Simplifying Debt

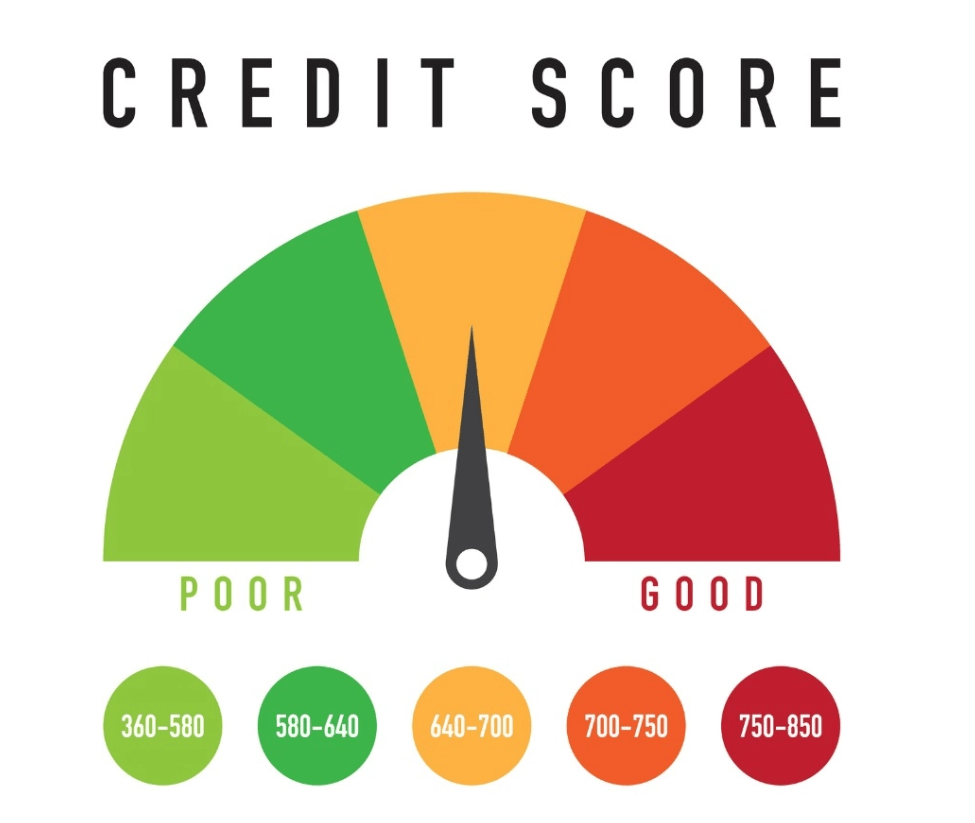

Debt consolidation can be a powerful tool for managing your finances, allowing you to simplify multiple debts into one manageable monthly payment. But did you know that debt consolidation can also provide an opportunity to boost your credit score? By using credit score increase tricks, you can not only reduce your debt but also improve your credit profile in the process.

In this blog post, we’ll explore how credit score increase tricks can help you make the most of your debt consolidation efforts and offer actionable advice to boost your score while simplifying your finances.

How Credit Score Increase Tricks Can Help You with Debt Consolidation

Before diving into specific strategies, it’s essential to understand how debt consolidation can impact your credit score. When you consolidate debt, your credit score may experience short-term fluctuations, especially if you close accounts or increase your credit utilization. However, with the right steps, you can minimize negative impacts and improve your score over time.

Keyways Debt Consolidation Affects Your Credit Score:

1. Credit Utilization: If you consolidate credit card debt onto a personal loan or home equity loan, your credit utilization ratio (how much of your available credit you use) will decrease, which can boost your credit score.

2. Credit History: Debt consolidation can extend your credit history if you keep older accounts open. The length of credit history makes up 15% of your credit score, so maintaining old accounts can be beneficial.

3. On-Time Payments: By simplifying debt, you’ll likely find it easier to make consistent, on-time payments. Since payment history accounts for 35% of your score, this will have a positive impact.

Credit Score Increase Tricks to Maximize the Benefits of Debt Consolidation

Now that you understand how debt consolidation can affect your credit score, let’s look at specific credit score increase tricks that can help you get the most out of the process.

1. Keep Older Accounts Open

When you consolidate debt, it’s tempting to close old accounts, but doing so can harm your credit score. Your length of credit history is an important factor in your credit score, so keeping older accounts open can help preserve your score in the long term.

🔹 Action Tip: Even if you no longer use your old accounts, keep them open. If possible, use them occasionally for small purchases to keep them active.

✅ Pro Tip: Closing accounts can increase your credit utilization ratio, which could negatively impact your score.

2. Monitor and Reduce Credit Utilization

Credit utilization plays a significant role in determining your credit score. After consolidating your debt, you may notice that your available credit has increased, which is great for lowering your credit utilization. Keeping this ratio low—preferably below 30%—will have a positive effect on your credit score.

🔹 Action Tip: If possible, keep your credit utilization below 10% for maximum score improvement.

✅ Pro Tip: Consider using a debt consolidation loan to pay down your credit cards and keep your balances low.

3. Make Payments on Time

The most crucial factor affecting your credit score is your payment history, which accounts for 35% of your score. By consolidating your debt, you streamline your payments, making it easier to stay on top of due dates and avoid missed payments.

🔹 Action Tip: Set up automatic payments for your consolidated loan to avoid late fees and ensure timely payments.

✅ Pro Tip: Timely payments will help improve your credit score and demonstrate to creditors that you are managing your debt responsibly.

Effective Credit Score Increase Tricks for Successful Debt Consolidation

4. Pay Down Debt Faster with Extra Payments

While debt consolidation simplifies your payments, it can also allow you to pay off your debt faster. By making extra payments toward your consolidated loan, you can reduce the overall balance more quickly, lowering your credit utilization and improving your credit score.

🔹 Action Tip: Use any extra income or savings to make additional payments toward your debt.

✅ Pro Tip: Check if your debt consolidation loan has any prepayment penalties before making extra payments.

5. Avoid Accumulating New Debt

One of the key mistakes many people make after consolidating their debt is incurring new debt. While it’s tempting to use credit cards or take out loans after consolidating, it can undo all the hard work you’ve done to improve your credit score.

🔹 Action Tip: Commit to using only the consolidated loan and avoid opening new credit cards or taking on additional loans until your finances are in a better position.

✅ Pro Tip: Create a budget to help you avoid overspending and accumulating new debt.

6. Monitor Your Credit Report for Errors

After consolidating debt, you should closely monitor your credit reports for any errors or inaccuracies. Mistakes on your credit report can lower your score unnecessarily and make it harder to achieve your financial goals.

🔹 Action Tip: Use tools like Credit Karma or visit the official website AnnualCreditReport.com to get your free credit reports and check for errors.

✅ Pro Tip: If you find errors, dispute them with the credit bureau to have them corrected.

Boost Your Credit Score During Debt Consolidation with These Expert Tricks

Successfully consolidating your debt and boosting your credit score requires discipline and strategy. By following the credit score increase tricks outlined above, you can not only simplify your debt but also improve your credit profile over time.

Get Help with Your Debt Consolidation and Credit Repair Today

At Cents Savvy, we specialize in credit repair services and debt consolidation solutions. If you’re ready to simplify your debt and boost your credit score, we can help guide you through the process.

📞 Contact us today for a free consultation and learn how we can assist you with your credit and debt management needs.

Visit Cents Savvy to learn more.